Analysis of Investment Scenario in Pakistan: Time Series Evidence

Research Article

Analysis of Investment Scenario in Pakistan: Time Series Evidence

Azra*, Muhammad Awais, Alam Khan and Muhammad Shoaib

Department of Economics, Kohat University of Science and Technology, Kohat, KPK, Pakistan.

Abstract | This paper made an attempt of econometric analysis of the investment situation in Pakistan for the period 1990-2017. The variables including domestic credit, national savings, lagged investment (IV), imports, and the real exchange rate were found to be the major factors affecting investment in Pakistan. Among all, the savings coefficient is positive and insignificant because of savings in Pakistan had no healthy pattern. Exchange rate has adversely affected the investment because of unidirectional causality. Specification and analytical tests supported reliability of the investment does not affect investment model from key econometric issues. The stability test shows that investment fluctuated during the 1990-2017 periods. OLS and GMM results are comparable. OLS estimation results are reliable since these variables do not suffer from Endogeneity problem.

Received | June 14, 2020; Accepted | January 13, 2021; Published | April 28, 2022

*Correspondence | Azra, Department of Economics, Kohat University of Science and Technology, Kohat, KPK, Pakistan; Email: azra_alam2009@yahoo.com

Citation | Azra, M. Awais, A. Khan and M. Shoaib. 2022. Analysis of investment scenario in Pakistan: Time series evidence. Sarhad Journal of Agriculture, 38(2): 669-675.

DOI | https://dx.doi.org/10.17582/journal.sja/2022/38.2.669.675

Keywords | Domestic credit, Exchange rate, Imports, Investment analysis, Pakistan

Copyright: 2022 by the authors. Licensee ResearchersLinks Ltd, England, UK.

This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Introduction

Investment refers to the net addition to capital stock which is used for future production. It is a crucial ingredient of the national income identity. Investment augments physical, financial as well as human capital, each of them has its role in the production of an economy. Health and training facilities are most likely to increase the productivity and efficiency of the labor force. Investment in machinery, inventories, buildings, land, and computers, will make considerable accumulation to the productivity. Financial investment generates profits in various shapes including earning of interest on dividend, bonds and protections, value, and reinvestment of benefit to upgrade both profitability and benefit.

According to Afzal (2004a) reserves and investment are primary large-scale variables which are observed surely striking for attaining speedy financial development, for the major economic purpose of any development plan in an emerging nation. For the country, it is hard to locate, which had the option to develop a high rate for a significant stretch without encountering high paces of capital arrangement or potentially high paces of investment funds. Afzal (2010) reported that developing and developed countries reveal encouraging investment savings association and in both time series and cross-sectional research.

Accordingly, the fundamental job of speculation for actual output yield development is of top mystery since speculation both in microeconomic and macroeconomic contexts increases productive capacity which in turn initiates employment opportunities and consequently increased income. The contribution of investment to the economic growth of a country is of high importance and leads the country towards prosperity by dropping the unemployment rate. (Reilly and Brown, 2011) studied that speculation is the obligation of current funds within an exact period to obtain future expenses that give back to investors. It also invests funds for the anticipated inflation rate and the uncertainty of future payment.

Total investment growth rate was 21.8% (1970s), 4.2 % (1980s), 8.1% (1990s) and 15.6% (2000s). Private investment followed a similar trend. Total investment was the highest during the 1970s compared to the rest of the decades. The massive public sector investment in the 1970s accounts for this difference. Both investments were the lowest during the 1980s. Trade liberalization and institutional reforms ushered in the 1980s may be responsible for this fall (Afzal et al., 2018).

Law and order situations, political uncertainty, and unstable/inconsistent policies have declined investment in 2008, during which economic growth was 5.8 %. The shortfall in revenue collection and unnecessary expenses of government is the basic reason for fiscal deficit and decreased public and private investment due to which the economic actions slowed down (Hussain, 2008). Association between domestic and foreign investment has central importance in an economy. The increased investment by the private sector leads to huge profit on the venture in the local economy whereas public investment shows the infrastructure enhancement and thereby decline in the cost of running the business. These parts of local investment inspire overseas investors to obtain the benefits of huge profit (Ndikumana and Verick, 2008).

Similarly, foreign capital inflow to domestic economy is also useful for the host country’s investors. The collision of foreign direct investment on domestic investment is uncertain as it has both crowding out or crowding in effects. Crowding out effect of FDI shows that it is meaningless for FDI recipient country but crowding in force of FDI on domestic investment is advantageous for the host country (Amadou, 2011).

This is a common observation that the law and order situation, the economic credibility among the world economies, and feasible and economic investment opportunities leave a positive effect on the investment of an economy. The part played by fiscal fascism, by possession markup rates below market clearance levels, is nevertheless contentious. The idle issue is that the need to proportion credit increases the potential for misallocation of wealth.

Therefore, objective of the paper is to investigate empirically the investment scenario in Pakistan for the period 1990-2017. The significance of the study lies in the fact that the investment situation in Pakistan is analyzed based on recent dynamics of investment and is expected to provide valuable policy prescriptions in order to augment investment contribution to economic growth. Therefore, the investment is studied from a much broader perspective to get pragmatic guidelines because increasing investment at an increasing rate is inevitable for promoting employment and output.

Materials and Methods

Investment plays a key role in an economic development. There are so many determinants of investment in Pakistan. Among all, some important determinants have been taken here.

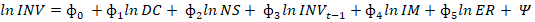

Investment model

Investment is an increasing function of income but a decreasing function of the interest rate. Hence interest rate does play a role in influencing the investment. However, because of several interest rates and lack of reliable time-series data on the interest rate, it is not included in our investment equation. Nevertheless, in a macroeconomic context, investment depends on other factors too as discussed below. Investment is considered as a net count to the wealth stock and performs a major role in increasing public revenue. Speculation greatly depends on huge reserve funds. Observational proof shows that nations have accomplished high monetary development because of sufficient reserve funds (Afzal, 2013). Since capital stock is inaccessible mainly for the underdeveloped nations due to innate issues of measurement, complete IV is used for wealth.

It alludes to loaning or credit that a state central bank makes accessible to borrowers inside similar limits. This may also include business banks and even include the public authority itself. According to (Afzal, 2004b) business firms in developing countries depend greatly on bank credit to finance additions to their capital stock. Therefore, the supply of domestic credit (DC) assumes a decisive role in promoting investment. Its coefficient is expected to be positive. According to Ashfaque (1988), “the money and capital markets remain underdeveloped, and the rate of interest is not resolved by the free play of market forces rather it is directed by the financial specialists and in this manner, it doesn’t mirror the genuine expense of financial speculation”.

Moreover, in the Keynesian model, the connection between the real and financial areas is given by the pace of revenue through its impacts on the venture. Because of the well-developed capital market, it is a standard method in advanced countries. However, the connection seems to be inappropriate in underdeveloped countries. Therefore, bank credit essentially offers a bond both among the real and financial sectors.”

National savings (NS) is the summation of both public and private savings. It is equivalent to a nation’s income less consumption and government purchases. The need for increased savings and thus investment inappropriate economic growth is generally recognized because these factors play a central role in accelerating economic growth (Afzal, 2004a). If the demand for saving is more than it supplies, then the nation will fulfill its need by turning to outside help that has numerous unfriendly political as well as economic repercussions. Studies have revealed that nations with growing savings to GDP ratio have noted stunning economic growth (Afzal, 2010).

Lagged investment (INVt-1) demonstrations difference in current and previous year investment. Data for the lagged variable has been calculated from the gross investment Imports (IM) play an important role in affecting investment as increasing investment leads to increasing demand for imports. “Manufacturing industries in Pakistan are heavily dependent on imports for their requirement of capital and international goods; rigid import quota neither allows optimal allocation of investment nor let the industries use their capital at an optimal level of intensity” (Kemal, 1998). And ER is the exchange rate which refers to the domestic price of the foreign currency. All coefficients are relied upon to have positive signs but for exchange scale and ln = natural logarithm. Log is utilized to smooth the information.

Table: Variable Description

|

Variables: |

Code: |

Description: |

|

Gross Investment |

Ln INV |

Investment is considered as a net count to the wealth stock and performs a major role in increasing public revenue. |

|

Domestic Credit |

Ln DC |

It alludes to loaning or credit that a state central bank makes accessible to borrowers inside similar limits. This may also include business banks and even include the public authority itself. |

|

National Saving |

Ln NS |

National saving is the summation of both public and private saving. |

|

Lagged Investment |

LN INVt-1 |

Lagged investment demonstrations difference in current and previous year investment. Data for the lagged variable has been calculated from the gross investment |

|

Imports |

Ln IM |

Imports play an important role in affecting investment as increasing investment leads to increasing demand for imports. |

|

Exchange Rate |

LN ER |

It refers to the domestic price of the foreign currency. |

Ψ = error term that fulfills classical linear regression model presumptions. The Table shows the definition of variables for better understanding.

Results and Discussion

Determinants of investment were thoroughly evaluated one by one and the whole model was checked for OLS, Granger Causality, Specification & Diagnostic Tests, and GMM.

Domestic Credit, National Saving, Lagged Investment, Imports and Exchange rate have been tested first by OLS Method. OLS outcomes are provided in Table 1.

For business firms, domestic credit (DC) is of paramount importance because they may lack internal funds and equity to finance new investments. However, they do not rely exclusively on DC due to the cost of borrowing. Its coefficient is positive and significant. However, an increased supply of DC is expected to influence investment positively (Table 1).

Savings and investments are positively correlated. The savings coefficient is positive and insignificant. This result does not imply to belittle savings role in investment. Lagged investment and imports are highly significant. Lagged investment does serve as a guideline to decide about future investment just as farmers decide current period output based on agriculture lagged year supply. Its highly significant coefficient points out the fact. In the checkered history of Pakistan’s economic development, imports have increased over the decades to feed industry and meeting the needs of consumers and business firms. The exchange rate has the expected negative but insignificant coefficient because depreciation of the exchange rate makes imports expensive that discourages investment. That is why more recently investment has fallen.

Table 1: OLS Outcomes of Investment model.

|

Variable(log) |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

1.052 |

0.82 |

1.27 |

0.22 |

|

Dc |

0.20 |

0.108 |

1.90 |

0.09 |

|

Savings |

0.03 |

0.11 |

0.27 |

0.78 |

|

inv(-1) |

0.47 |

0.18 |

2.63 |

0.01* |

|

Im |

0.48 |

0.15 |

3.18 |

0.004 |

|

Er |

-0.09 |

0.14 |

-0.65 |

0.51 |

|

R2 |

0.99 |

DW=1.54 |

F-statistic |

924.72 (0.000) |

* Shows 5% level of significance,

Granger Causality: Investment Model

Since modest used modestly long period data (1990-2017), it was considered desirable to examine the time-series properties of data. Time series data having unit roots is known as non-stationary (Gujurati, 1999). The investment model variables were explored for unit roots and cointegration. The variables included in the investment were found to be all non-stationary that is possessed a unit root. However, no cointegration was found (results are available on request). Since the investment model showed a lack of cointegration among the underlying variables, therefore, variables were examined for Granger Causality which is briefly explained below. This causality is sensitive to the lag length. VAR (Vector Auto Regression) selection criteria recommended lag 1. This is reasonable because for annual data one-year lag is normally correct.

Granger Causality

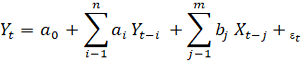

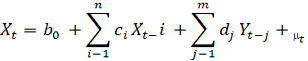

If the factors are not cointegrated, one can utilize standard Granger causality test. For playing out this among Yt and Xt arrangement following conditions are utilized:

(1)

(1)

(2)

(2)

Wherever, a0 and b0 are limits addressing interrupt terms. εt and t are uncorrelated background noise. One variable X Granger causes extra factor Y if Y is clarified satisfactorily by using going before principles of Y likewise before to see whether expansion of slacked upsides of X can build the depiction. X Granger-causes Y doesn’t imply that Y is the result or the impact of X. By considering the above conditions three sorts of essential affiliations can arise. If bj or dj is significant, there is unidirectional causality from X to Y or from Y to X. There is bi-directional causality if commonly bj and dj are measurably critical. X and Y don’t cause each other if the coefficients of X in condition (2) and of Y in condition (3) are measurably unimportant (Afzal, 2010).

Table 2 shows Granger Causality results for the investment model. For this model, H0 that lninv does not Granger Cause lner is rejected based on F-statistic implying that exchange rate causes investment. That is there is unidirectional causality from exchange rate to investment which means that investment is affected by exchange rate which has been depreciating rapidly. F-statistics are not significant for other determinants.

Table 2: Results of Granger Causality- Investment Model.

|

Null Hypothesis |

Observations |

F- statistics |

Probability |

|

lndc does not granger cause (DNGC) lninv lninv DNGC lndc |

27 |

0.27 1.64 |

0.60 0.21 |

|

lnsavings DNGC lninv lninv DNGC lnsavings |

27 |

2.09 0.82 |

0.1605 0.3727 |

|

lnimports DNGC lninv lninv DNGC lnimports |

27 |

0.14 2.90 |

0.7109 0.1014 |

|

lner DNGC lninv lninv DNGC lner |

27 |

0.01 3.22 |

0.9015 0.0850 |

Specification and diagnostic tests

Ramsey Reset is useful that is the regression model is accurately determined. These tests were acquired by E-views 8. For the model, F-measurement, and t- measurement are unimportant implying that this model doesn’t experience the ill effects of useful misspecification. Breusch Godfrey sequential connection LM test, Heteroscedasticity (White), and Normality JB estimation are additionally unimportant implying that the model does not experience the ill effects of main econometric issues and outcomes recommend statistical correctness and sufficiency of the assessed model (Table 3). Multicollinearity is demonstrated by the VIF (Variance Inflation Factor) that surpasses10 (Gujurati, 1999). However, on average outcomes don’t disregard the axiom substantially.

Table 3: Specification and diagnostic tests: Investment model.

|

Test |

Result |

VIF |

|

Ramsey Reset |

F(1,20)= 0.25 (0.6223) |

46.98527 |

|

LM Test |

t(20)=0.500 (0.2117) |

1.487289 |

|

Heteroscedasticity (White) |

F(1,20)=1.66 (0.2117) |

137.5787 |

|

Normality JB statistic |

Chi-square (2)= 0.83 (0.6584) |

116.3390 |

|

- |

- |

18.99821 |

Parameters stability

To set up the security of the boundaries Chow Breakpoint test was used which is a primary solidness test. Two sub-examples 1991-2000 and 2002-2017 were chosen. 1991 was picked as a breakpoint since Pakistan left on a comprehensive huge-economic change and in like manner in 2002 Pakistan come in the War-on-fear. Both have affected Pakistan’s economy.

The F statistic depends on the residual sums of squares and the LR (likelihood Ratio) statistic is based on the constrained and unconstrained maximum of the likelihood function. The result from the test is an F and LR statistic with linked probabilities (Gujurati, 1999). For investment Model mutually F and LR statistic are significant for 1991 and 2002 periods both periods meaning that investment has fluctuated during the period under review. The investment was affected by the factors mentioned above (Table 4).

GMM (Generalized Method of Moments)

OLS method is the most basic and popular method of estimation. However, this method faces an Endogeneity problem. GMM is a general model that estimates parameters in a statistical model. GMM method possesses desirable statistical properties of consistency, efficiency, and asymptotic normality. Moreover, GMM overcomes the Endogeneity problem. GMM literature assumes stationarity in the variables of the model but also used for non-stationary variables.

Table 4: Breakpoint Test.

|

Period |

Model – Investment |

|

1991 |

F(6,15)=8.98 (0.0003)* |

|

LR=40.96 (χ2 (6)= 0.0000) |

|

|

2002 |

F(6,15)=2.49 (0.0708) |

|

LR= 14.96 (χ2 (6)= 0.0047) |

* Shows 5% level of significance,

Endogenous Variable: Investment.

Method: Generalized Method of Moments.

Instrument specification: lnm2lnglncpilnpopglnindustry c.

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

-0.84 |

0.65 |

-1.29 |

0.2098 |

|

Lndc |

0.022 |

0.08 |

0.26 |

0.7918 |

|

Lnsavings |

0.27 |

0.08 |

3.35 |

0.0031* |

|

lninv1 |

0.35 |

0.15 |

2.31 |

0.0318* |

|

Lnim |

0.57 |

0.11 |

5.33 |

0.0000* |

|

Lner |

-0.02 |

0.09 |

-0.24 |

0.8057 |

|

ar(1) |

0.44 |

0.14 |

2.96 |

0.0077* |

|

R2 |

0.98 |

Adj R2 = 0.97 |

DW= 2.23 |

J-statistic 4.59(0.59) |

* Shows 5% level of significance,

Natural log has been taken for all the variables available in model.

Investment Model-OLS results (Table 1) and GMM (Table 5) results are equally good and comparable.

The endogeneity test based on Chi-square statistic tests the null hypothesis that regressors are exogenous. According to (Gujurati, 1999), the Endogenous variable is related to the dependent variable while explanatory variables represent an exogenous variable. Since H0 has been accepted due to insignificant value by the Endogeneity test for the investment model (Table 6) implying that the regressors are exogenous and therefore, OLS estimation results are reliable since these do not suffer from Endogeneity problem.

Table 6: Endogeneity Test: Investment.

|

Value |

Df |

Probability |

|

|

Difference in J-stats |

4.802708 |

5 |

0.4404 |

|

J-statistic summary |

|||

|

Restricted J-statistic |

5.128674 |

||

|

Unrestricted J-statistic |

0.325966 |

||

Conclusions and Recommendations

This paper made an econometric analysis of the investment situation for the time span 1990-2017. The investment is a vibrant macro variable for policymakers which pay considerable attention. Domestic credit, national savings, lagged investment, imports, and real exchange rate were found to be the major factors affecting investment in Pakistan.

Business firms do not rely solely on DC owing to the cost of borrowing. DC coefficient is positive but significant. Nevertheless, an increased supply of DC is expected to influence investment positively. Both savings and investments are positively correlated. The savings coefficient is positive and insignificant because savings in Pakistan has not followed a healthy trend. Lagged investment and imports are highly significant. Lagged investment does serve to decide about a future investment like agriculture lagged-period supply. The exchange rate had the expected negative but insignificant coefficient because depreciation of the exchange rate makes imports expensive that discourages investment. That is why more recently investment has fallen. Variables are non-stationary but there is no cointegration.

For the investment model, F-statistic and t-statistic are not significant which means that this model doesn’t hurt from functional misspecification. Breusch Godfrey serial association LM test, Heteroscedasticity (White), and Normality JB statistic are all irrelevant meaning that the model doesn’t suffer from main econometric issues and these outcomes recommend the statistical suitability and reliability of the estimated model. F and LR statistics for both periods revealed that investment fluctuated during 1990-2017.OLS and GMM results are comparable. An insignificant value by the Endogeneity test for the investment model implies that the regressors are exogenous. OLS estimation results are reliable since it does not suffer from Endogeneity problem.

Novelty Statement

In this research study, investment is connected with exports rather than exports and imports are considered.

Author’s Contribution

Azra: Designed the study, collected data and wrote this manuscript.

Muhammad Awais: Reviewed the literature.

Alam Khan: Performed quantitative data analysis.

Muhammad Shoaib: Helped in final editing in the manuscript.

Conflict of interest

The authors have declared no conflict of interest.

References

Afzal, M. 2004a. Estimating saving and investment functions in Pakistan. Philippine Rev. Econ., 41.

Afzal, M. 2004b. Exports economic growth nexus: Pakistan’s experience. Indian J. Econ., 3: 315-340.

Afzal, M. 2010. Savings and investment in developing countries: Granger causality test. Philippine Rev. Econ., 44.

Afzal, M. 2013. National savings and foreign capital in Pakistan. Appl. Econ. Int. Dev., 13: 197-206.

Afzal, M., Ahmad, D. and Zaman, Z. 2018. Analysis of socio-economic indicators scenario in Pakistan. J. Global Econ., 14: 206-218. https://doi.org/10.1956/jge.v14i3.504

Amadou, A. 2011. The effect of foreign capital on domestic investment in Togo. Int. J. Econ., 3: 223-226. https://doi.org/10.5539/ijef.v3n5p223

Ashfaque, H., and Khan. 1988. Macroeconomic policy and private investment in Pakistan. Pak. Dev. Rev., 27: 278-291. https://doi.org/10.30541/v27i3pp.278-291

Gujurati, D. 1999. Basic econometrics Mc Graw Hill. İstanbul: Literatür Yayıncılık.

Hussain, F. 2008. Pakistan’s economic growth may pick up to 6.5 percent next year: Adb. Business Recorder.

Kemal, A.R. 1998. Industrial development in Pakistan. Pak. J. Appl. Econ., 14: 107-119.

Ndikumana, L. and Verick, S. 2008. The linkages between fdi and domestic investment: unravelling The developmental impact of foreign investment in sub saharan Africa. Dev. Pol. Rev., 26: 713-726. https://doi.org/10.2139/ssrn.1136458

Reilly, F.K. and Brown, K.C. 2011. Investment analysis and portfolio management.Cengage Learning, 1080 pages

To share on other social networks, click on any share button. What are these?